Over the past decade, China’s onion industry has undergone a remarkable transformation, solidifying its position as a global powerhouse in production, export, and innovation. By leveraging its vast agricultural resources, technological advancements, and supportive policies, China has become a pivotal player in the global onion market. However, the industry faces complex challenges ranging from environmental constraints and technological gaps to geopolitical risks and evolving consumer demands. This 3,000-word analysis provides a comprehensive overview of the industry’s current landscape, examining key achievements, critical challenges, and actionable strategies for sustainable growth. Drawing from the latest data, industry reports, and global market dynamics, this article offers a comprehensive view of China’s onion industry.

Current Developments:

1. Production Scale and Export Dynamics:

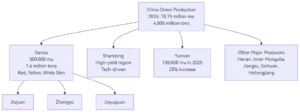

China is one of the world’s leading onion producers. It has over 750,000 hectares of cultivated onion land in key provinces, including Shandong, Gansu, Yunnan, Inner Mongolia, and Xinjiang. According to 2025 FAO data, China’s onion yield averages 70 tons per hectare, which is three times the global average. This drives total production to over 5.2 million tons annually.

The map below shows the main onion-producing regions in China:

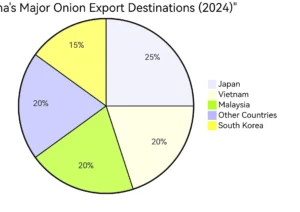

This productivity enables substantial exports. For example, in 2024, China exported 1.8 million tons of onions, valued at $1.5 billion. This accounted for 12% of global trade. Key export destinations include Vietnam (32%), Japan (22%), Malaysia (18%), Russia (10%), and emerging markets such as Nigeria and Mexico. China’s ability to supply onions year-round is facilitated by its diverse climatic zones and advanced cold storage technology, ensuring a continuous market presence.

2. Quality and Safety Benchmarking:

The industry prioritizes quality control by strictly adhering to GB 2763-2021, China’s food safety standard. Since 2020, pesticide residue incidents have decreased by 25%, aligning with Codex Alimentarius norms. “Green Food” and “Geographical Indication” certifications (e.g., Jiayuguan and Xichang onions) have increased brand value and commanded premium prices in export markets. For example, exports of organic onions to the EU increased by 30% in 2024 due to strict safety compliance. Producers are increasingly adopting integrated pest management (IPM) techniques to reduce their reliance on chemicals.

3. Supply Chain Digitalization and Modernization:

China’s onion supply chain has undergone digital transformation. IoT sensors monitor warehouse humidity and temperature, and blockchain systems track onions from farm to retail. Alibaba’s “Fresh Produce Platform” and JD.com’s logistics network connect farmers with urban consumers, eliminating intermediaries. Cold chain infrastructure has expanded. Shandong now has 500 temperature-controlled warehouses, which have reduced post-harvest losses to 8-10%. Though uneven, mechanization has reached 50% in key provinces, with automated harvesters and sorting machines deployed in Gansu and Yunnan.

4. Value-Added Processing and Diversification:

China’s processing sector has grown beyond fresh onions. The market for onion powder, flakes, oils, and extracts reached $3 billion in 2024, driven by global demand for convenient foods and health supplements. Shandong’s high-tech processing hubs export onion powder to the US and quercetin-rich extracts to Europe. Yunnan has innovated by producing freeze-dried onion chips for health-conscious consumers. Notably, China’s exports of onion oil surged by 40% in 2024, reaching a value of $200 million, as the cosmetics and pharmaceutical industries utilize its anti-inflammatory properties.

5. Policy-Led Advancements and Research:

Government support is robust. The “14th Five-Year Plan for Agriculture” allocates $2 billion for onion research and development (R&D), mechanization, and water conservation. Provinces offer incentives: For example, Gansu subsidizes $500 per hectare for adopting drip irrigation, and Henan provides $50,000 grants for cooperative mechanization centers. The Gansu Onion Molecular Breeding Center is developing drought-tolerant hybrids in collaboration with China Agricultural University. In Xinjiang, pilot projects test solar-powered desalination systems for irrigation to address water scarcity.

Key challenges:

1. Environmental and Sustainability Pressures:

- Water scarcity: Gansu’s onion cultivation uses 45% of the region’s agricultural water, which exacerbates desertification in areas such as Minqin County. Only 20% of farms use solar-powered drip systems.

- Plastic pollution: Annual plastic mulch usage (7 million kg) contaminates soil. Biodegradable alternatives remain costly ($3,000/ton vs. $800/ton for traditional plastic).

- Carbon Footprint: Long-haul transport to Europe emits 1.2 million tons of CO₂ annually, which challenges China’s goal of achieving carbon neutrality by 2060.

2. Technological and Mechanization Deficits:

Mechanization lags globally. While Shandong has achieved 60% mechanization, smallholders in Yunnan and Guizhou still rely on manual labor. Key barriers include:

- The high cost of machinery ($150,000 for a harvest robot versus $50,000 in the Netherlands).

- Irregular terrain hinders large equipment.

- A lack of skilled technicians for maintenance.

3. Seed dependency and research bottlenecks:

China imports 70% of its high-yielding hybrid seeds, particularly for yellow onions, from Japan, South Korea, and the Netherlands. Domestic breeding faces:

- Long cycles (12–18 years) for climate-resilient varieties.

- Limited private investment ($80 million per year versus $300 million in the U.S.).

- Intellectual property theft, which deters innovation. Reliance on imported seeds risks supply chain disruptions during trade tensions.

- Market Volatility and Geopolitical Risks:

- Price Fluctuations: Onion prices fluctuate significantly. In 2024, for example, prices spiked by 50% following India’s export ban, which impacted China’s export volumes.

- Geopolitical Vulnerability: Seventy-five percent of exports are concentrated in Asia, which exposes the industry to trade disputes. South Korea’s 2024 tariff hike reduced shipments by 20%.

- Domestic consumption constraints: Per capita onion consumption (7.5 kg/year) lags behind global averages, indicating untapped domestic potential.

5. Consumer Demand Shifts and Innovation Deficits:

Global consumers seek specialized onions (e.g., tearless, low-pungency, organic), while China’s offerings remain largely commodity-driven. Domestic breeding lags in:

- Health-focused varieties (e.g., onions with high quercetin content for diabetes prevention).

- Processed products targeting niche markets (e.g., keto-friendly onion powders) are lacking as well.

- Plant-based alternatives, such as onion flavor extracts for vegan diets, which represent a $5 billion global market.

6. Post-Harvest and Infrastructure Deficiencies:

Rural regions lack advanced cold storage, resulting in spoilage losses exceeding $700 million annually. Transportation inefficiencies, such as the lack of refrigerated trucks in western provinces, increase costs by 15-20%. In comparison, the US maintains a 98% cold chain coverage rate.

7. Smallholder Integration and Knowledge Gaps:

While large farms adopt modern practices, 60% of smallholders lack access to training in IPM, mechanization, and digital tools. Information asymmetry exacerbates compliance challenges with GB 2763-2021, resulting in rejections in export markets.

Future Strategies and Opportunities:

1. Accelerate indigenous seed innovation.

- Create “National Onion Innovation Hubs” that integrate AI-driven breeding techniques, such as CRISPR for disease resistance.

- Create seed banks to preserve indigenous germplasm.

- Incentivize private investment through tax breaks and intellectual property (IP) protection, such as 10-year patent exemptions.

- Scale Mechanization and AI Integration:

- Subsidize local agricultural machinery manufacturers to develop affordable, terrain-adaptive machinery ($100,000 harvest robots).

- Pilot AI solutions, such as drone spraying, autonomous weeding robots, and machine learning for pest prediction.

- Establish 50 mechanization training centers by 2030.

- Green Transition and Circular Economy:

- Mandate biodegradable mulch. Phase out traditional plastic by 2030 through $2,000/ton subsidies and penalties for noncompliance.

- Waste-to-value: Build 100 biogas plants that convert onion waste into electricity, similar to Hebei’s 10,000-ton-per-year facility.

- Carbon Offsetting: Collaborate with international carbon markets to monetize emissions reductions (e.g., selling credits for solar-powered farms).

- Market Diversification 3.0:

- Penetrate high-growth regions: Africa (Nigeria and Ethiopia, driven by urbanization) and Latin America (Argentina and Chile).

- Develop culturally tailored products, such as spicy red onions for Middle Eastern markets and organic baby onions for European gourmet retailers.

- Explore direct-to-consumer (DTC) channels in the US and Australia through cross-border e-commerce platforms (e.g., SheinFresh).

- Policy-Led Infrastructure Upgrades:

- Build “smart onion clusters” that integrate R&D centers, processing hubs, and logistics parks (e.g., the Zhangye Agri-Tech Zone in Gansu).

- Improve rural connectivity by constructing 5G networks for IoT monitoring and building 15,000 additional cold storage facilities by 2030.

- Implement “green tax credits” for eco-friendly practices ($5,000 per farm for adopting solar irrigation systems).

- Global Collaboration and Standardization:

- Harmonize China’s onion standards (e.g., pesticide limits and packaging) with EU and US regulations to reduce trade barriers.

- Join international research consortia (e.g., the Global Onion Improvement Network) to share germplasm and technologies.

- Establish bilateral onion trade agreements with Brazil and Nigeria.

- Consumer Education and Domestic Market Expansion:

- Launch campaigns to promote the health benefits of onions (e.g., diabetes management and immune boosting) through TV ads and social media.

- Develop affordable, onion-based products for low-income regions, such as fortified flour blends with onion powder.

- Partner with schools to include onion cultivation in agricultural education curricula.

Emerging Trends and Future Scenarios:

Biofortification: Engineering onions with enhanced nutrient profiles (e.g., selenium-enriched varieties).

Vertical Farming: Pilot indoor onion cultivation in urban centers to reduce transportation emissions.

Onions as Medicine: Researching onion extracts for cancer treatments and antibiotic alternatives.

Meta-verse marketing: Utilizing VR/AR to showcase onion farms and production processes to consumers.

Conclusion:

China’s onion industry is at a pivotal juncture. Its unparalleled production scale, export dominance, and policy support form a robust foundation. However, overcoming environmental constraints, technological gaps, seed reliance, and market vulnerabilities requires a radical transformation. Success hinges on a multifaceted strategy that includes accelerating indigenous seed innovation, embracing green technologies, diversifying markets, integrating smallholders, and fostering global collaborations. Transitioning from a “volume-driven” producer to an “innovation- and sustainability-driven” leader will not only secure China’s position in the global onion economy, but also allow it to pioneer new paradigms in intelligent, eco-friendly agriculture. This path forward requires bold investments, regulatory coherence, and a commitment to long-term ecological stewardship, which would position China as a global beacon for resilient food systems.