The European Union’s fertilizer market, encompassing 179.9 million hectares of agricultural land (27 billion mu) with 133.9 million hectares under fertilization, operates under a sophisticated regulatory framework. This article examines the intersecting requirements of REACH (EC 1907/2006), Fertilizing Products Regulation (FPR EU 2019/1009), CE marking, and biostimulant registration that govern the €32.9 billion fertilizer sector. With nitrogen fertilizers constituting 47% of EU imports and biostimulants growing at 10.43% CAGR, compliance is essential for market access.

Import Dependency

| Fertilizer Type | Import Share of consumption | Key Suppliers |

|---|---|---|

| Nitrogen Fertilizers | 32% | 47% Nitrates (dominant) |

| Phosphate | 65% | 50% from Morocco OCP Group |

| Raw Materials | 88% | 30% from Russia and Belarus |

| Biostimulants | €2.9B market | 10.43% CAGR |

GAGR=Compound Annual Growth Rate

2. Regulatory Framework Architecture

Regulatory Requirements for Fertilizer Products Entering the EU Market

-

Fertilizer Raw Materials: Substances or mixtures used in fertilizer production, primarily regulated under REACH.

-

Finished Fertilizer Products: Products ready for sale to end-users in agriculture, which must comply with both FPR and REACH regulations.

-

CE Marking: The core prerequisite for finished fertilizers is compliance with the EU Fertilizing Products Regulation (FPR).

2.1 REACH Regulation (EC 1907/2006)

Core Obligations:

-

Registration: Mandatory for substances >1 ton/year (dossier to ECHA)

-

Evaluation: Risk assessment by Member States

-

Authorization: Required for SVHC (Substances of Very High Concern)

-

Restriction: Bans on hazardous substances

Compliance Entities:

| Role | Responsibilities |

|---|---|

| Non-EU Manufacturers | Appoint Only Representative (OR) |

| EU Importers | Full REACH compliance |

| Downstream Users | Implement exposure controls |

2.2 Fertilizing Products Regulation (FPR EU 2019/1009)

Product Functional Categories (PFCs):

| PFC | Scope | REACH Trigger |

|---|---|---|

| PFC 1: Fertilizers | Inorganic/Organic NPK | CMC 1,3,4,5,6 |

| PFC 3: Soil Improvers | Biochar, Gypsum | Case-specific |

| PFC 6: Biostimulants | Microbial/Non-microbial | Mandatory |

Component Material Categories (CMCs):

-

High-Risk CMCs (1,3,4,5,6): REACH registration mandatory for CE marking

-

Other CMCs (2,7,8,9,10): REACH required if >1 ton/year imported

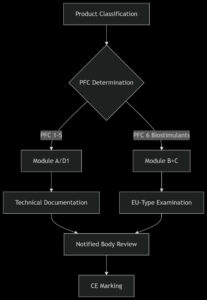

3. CE Marking Implementation Pathway

Conformity Assessment Modules

Documentation Requirements:

-

Chemical Safety Report (REACH Annex I)

-

Efficacy Data (CEN/TS 17700-1 for biostimulants)

-

Contaminant Testing:

-

Heavy metals (Cd <60mg/kg P₂O₅)

-

Pathogens (Salmonella spp. absent in 25g)

-

-

Declaration of Conformity (DoC)

4. Biostimulant Compliance (PFC 6)

4.1 Technical Requirements

| Parameter | Microbial | Non-microbial |

|---|---|---|

| Viability | >10⁹ CFU/g | N/A |

| Heavy Metals | As<40mg/kg | As<30mg/kg |

| Efficacy Proof | 2-season trials | 3-location studies |

| Label Claims | Strain ID + CFU | Active substance % |

4.2 Certification Process

-

Module B: Product design verification (Notified Body)

-

Module C: Manufacturing audit (ISO 9001 alignment)

-

Surveillance: Annual batch testing

5. Strategic Compliance Roadmap

5.1 REACH Registration Workflow

5.2 Cost Optimization Strategies

-

Consortium Registration: Share data costs for same substances

-

CMC Optimization: Select CMC 7/8/9 to avoid REACH (<1 ton)

-

Local Formulation: Blend imported raw materials in EU to avoid importer status

6. Penalty Framework for Non-Compliance

| Violation | Penalty Range | Regulatory Basis |

|---|---|---|

| Unregistered SVHC | €500,000-5M | REACH Art. 41 |

| Exceeding contaminant limits | Product recall + 15% annual turnover | FPR Art. 12 |

| False biostimulant claims | Market ban + €2M fine | EU 2026/1432 |

7. Future Regulatory Developments (2025-2027)

-

Digital Product Passports: QR codes linking to REACH/FPR dossiers (2026 mandate)

-

Carbon Footprint Declarations: Required for nitrogen fertilizers (ISO 14067)

-

Microplastic Restrictions: Polymer-coated fertilizers under REACH Annex XVII

“The REACH-FPR nexus represents the world’s most stringent fertilizer regulatory regime. Non-EU producers must integrate compliance into R&D phases to avoid 24-month market delays.”

— European Chemicals Agency (ECHA)